LAWTINO SOLUTIONS "uncovers the exact factors limiting your credit—because credit is what determines access to capital. We break down what’s blocking approvals, restraining funding, and slowing your business growth, then show you how to fix it.”

“ “How many opportunities are you turning down—not because of skill, but because of capital?”

“See if you qualify for a strategic credit review designed to unlock approvals and access capital. Complete the survey to find out what’s blocking your funding—and how to fix it.”

How It Works

Step 1

Gather Your Documentation

This allows us to verify your identity and to securely pull your credit score and report.

Step 2

Review Your Credit Report

Next, we’ll give you a credit score, report summary and negative item breakdown, absolutely FREE.

Step 3

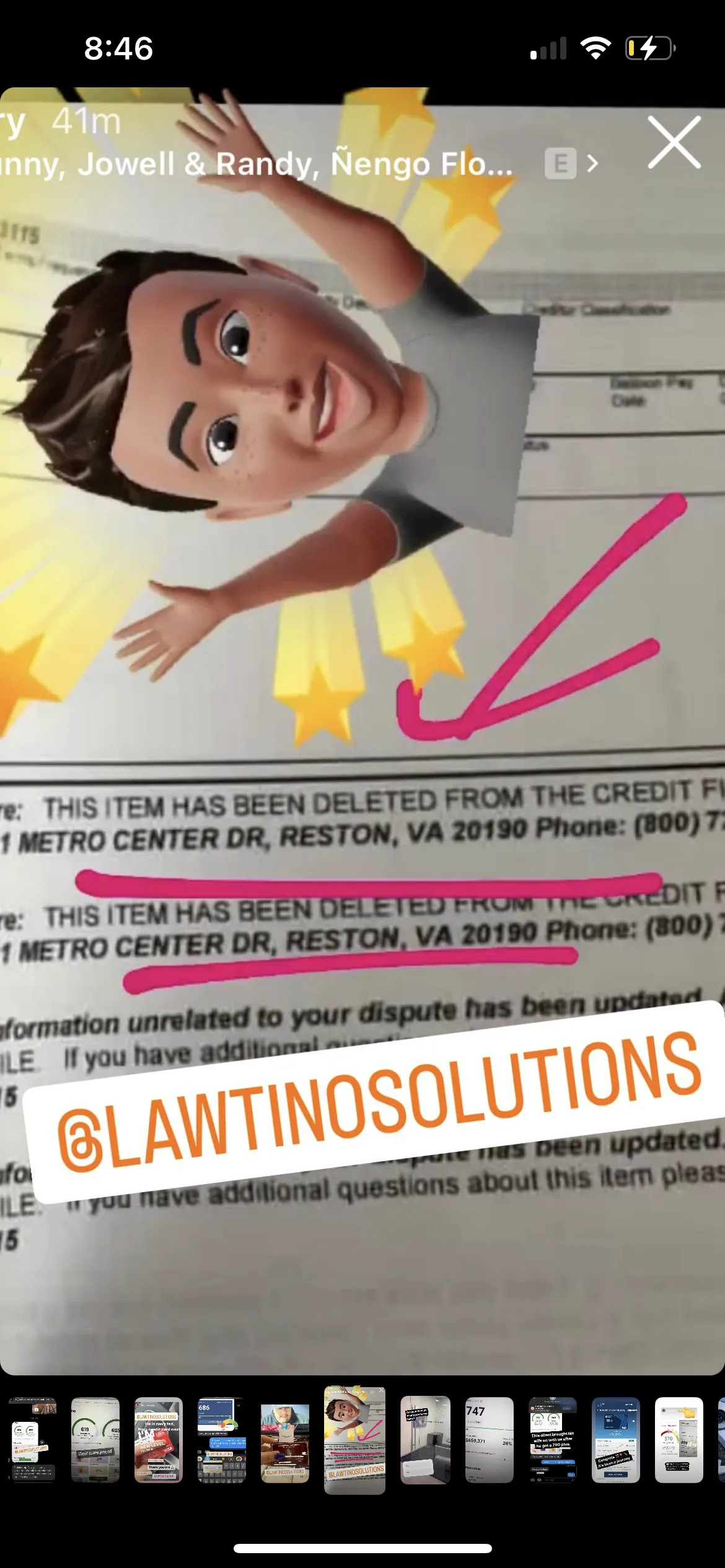

Dispute

Items

Based on your credit, we will generate custom information to dispute and represent you as the consumer.

Why LAWTINO SOLUTIONS?

Insightful Analysis

We specialize in identifying the factors impacting your credit score. Our consultation provides a detailed breakdown of what's affecting your financial health.

Personalized Business Solutions

Tailored recommendations based on your unique credit situation. Our experts devise a plan specifically for you.

Educational Empowerment

Gain valuable insights into credit management and learn how to improve and maintain a healthy credit score.

Trust and Security

Your information is safe with us. We maintain the highest standards of security and confidentiality.

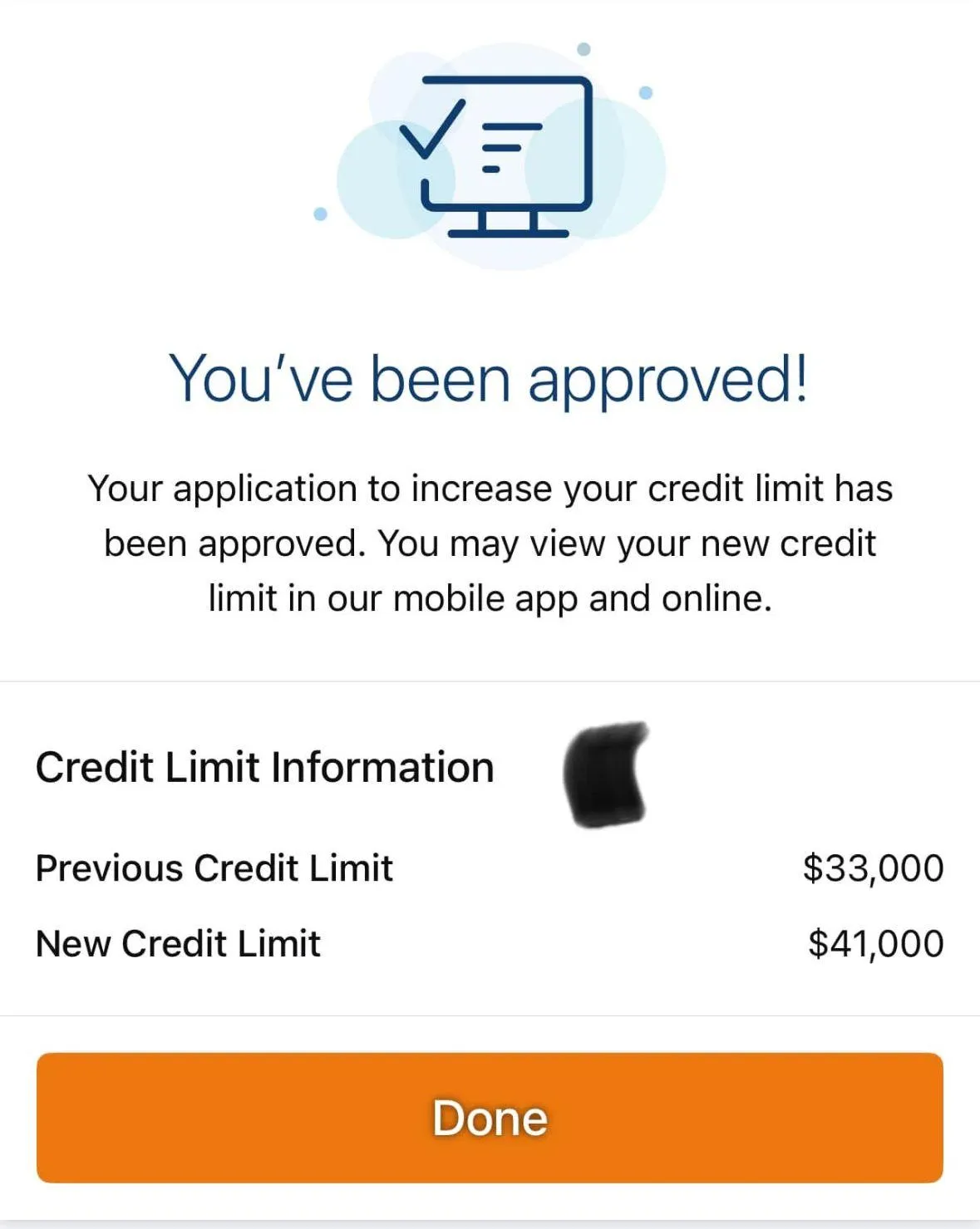

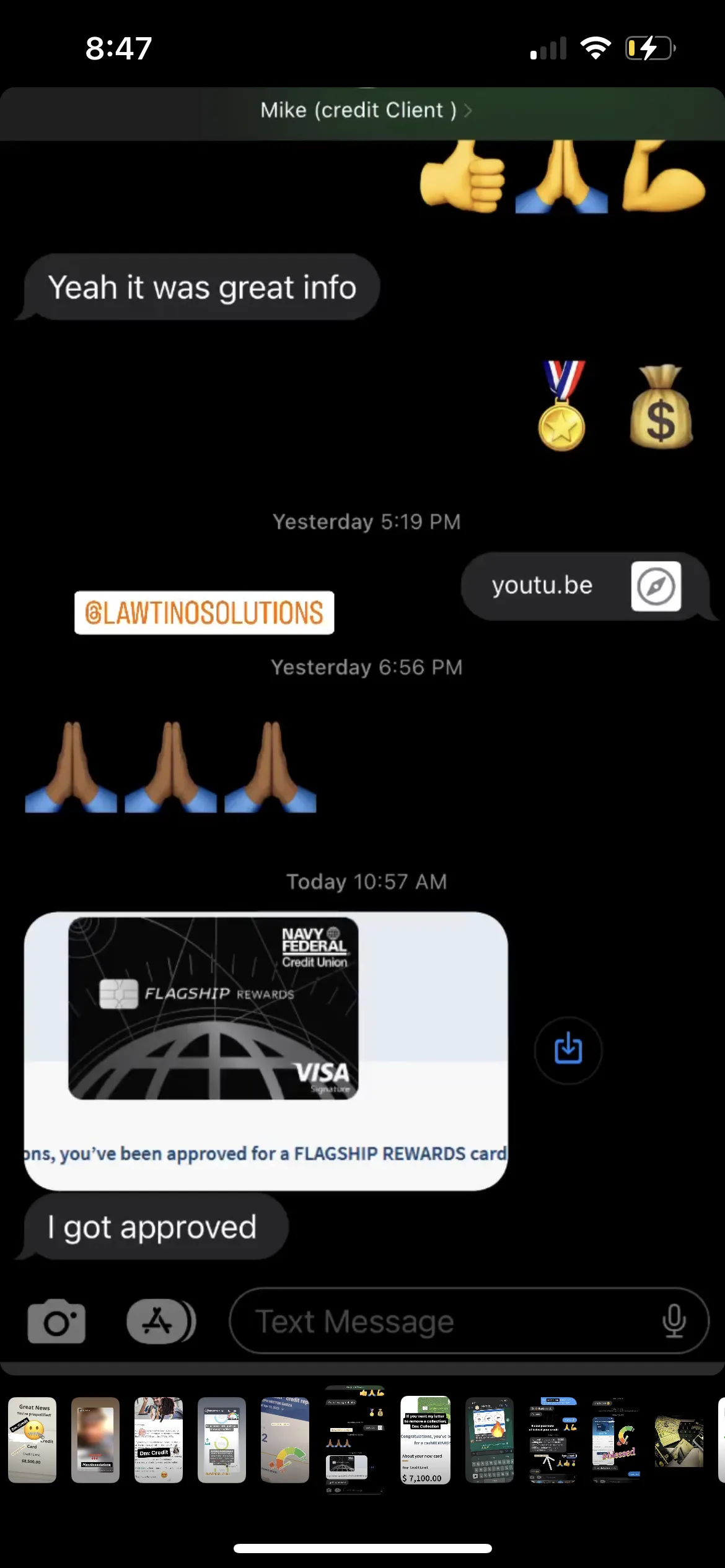

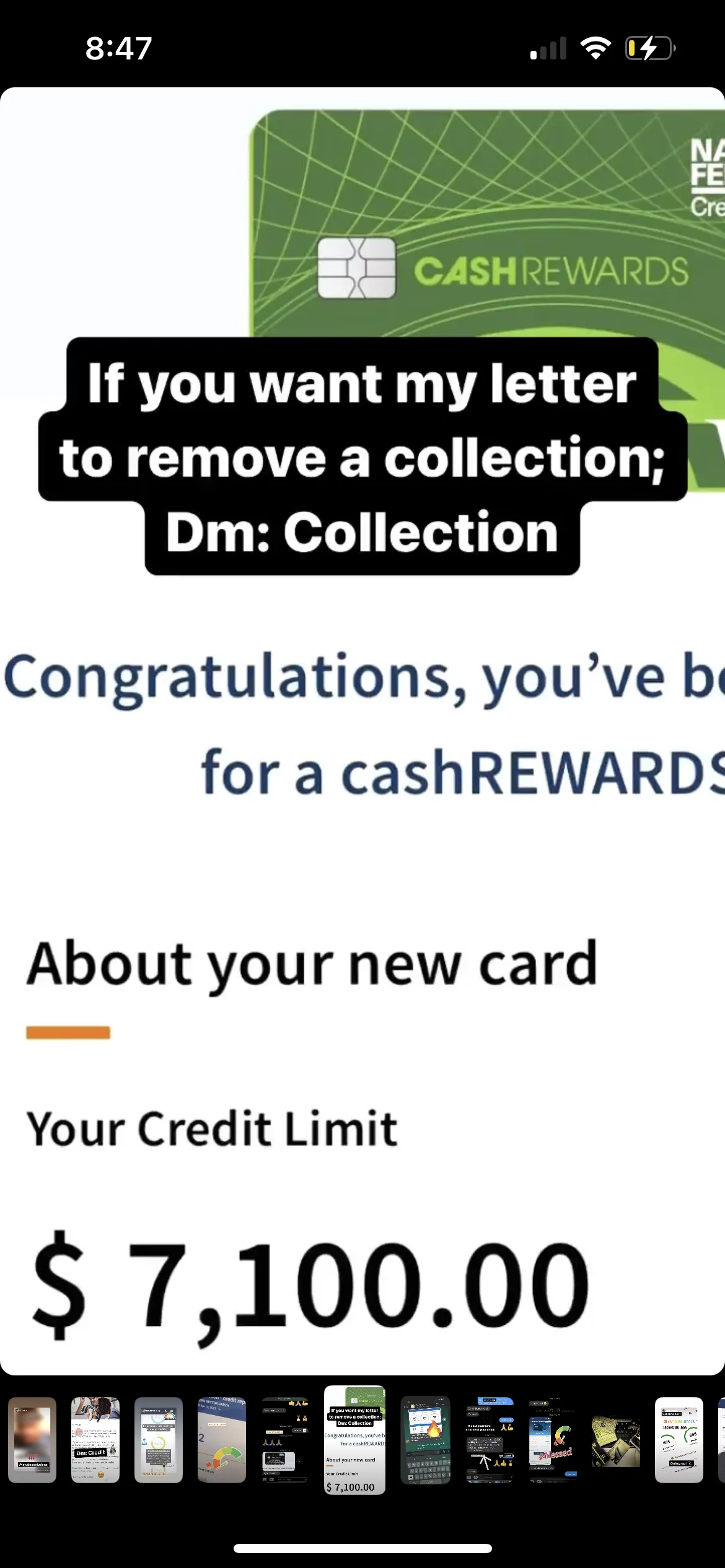

“We’ve helped thousands of people strengthen their credit profiles and unlock new financial opportunities.”

LAWTINO SOLUTIONS

FOUNDED BY

SANTIAGO BENJAMIN GIL

Santiago is a University of Southern California Alumni and a US Marine Veteran with two tours of Iraq. Through his own personal journey with credit repair, Santiago saw there was a lack of education around credit.

He set out to create a credit repair business that would not only serve clients by giving them a fresh start, but would empower them with education to help them continue on the path of good credit.

We look forward to serving you and getting you certified in the 700 Club. Lawtino Solutions has one goal, educate first and then fulfill our credit repair commitments to our clients.

LAWTINO SOLUTIONS

FOUNDED BY

SANTIAGO BENJAMIN GIL

Santiago is a University of Southern California Alumni and a US Marine Veteran with two tours of Iraq. Through his own personal journey with credit repair, Santiago saw there was a lack of education around credit.

He set out to create a credit repair business that would not only serve clients by giving them a fresh start, but would empower them with education to help them continue on the path of good credit.

We look forward to serving you and getting you certified in the 700 Club. Lawtino Solutions has one goal, educate first and then fulfill our credit repair commitments to our clients.

Frequently Asked Questions

What actually happens on the Credit Strategy Call?

This is not a generic “credit repair consultation.”

On the call, we treat your credit like a financial system, not a score.

We:

- Break down your entire credit profile and identify what’s actually holding you back from approvals

-Show you how lenders and financial institutions really evaluate risk

-Explain where your profile is leaking trust—and how to fix it

-Map credit decisions to real outcomes (home, car, business funding, leverage)

Think of this as a credit audit + growth strategy, not a sales pitch.

If we can’t clearly show you a path forward, we’ll tell you.

What do I walk away with?

You leave the call with clarity and leverage, not confusion.

Specifically:

-A custom credit plan aligned to your goals (personal, business, or both)

-A clear explanation of what to fix, why it matters, and in what order

-Ongoing access to a credit coach who stays current on lender rule changes and scoring updates

-Credit optimization and growth strategies most people never hear about until it’s too late

Even if you never move forward, you’ll understand your credit better than 90% of consumers.

Is this right for me?

This is for people who are done being denied.

Ask yourself:

-What would it be worth to stop getting declined for homes, cars, or funding?

-What does staying at the same credit level cost you over the next 5–10 years?

We are not for everyone.

We work best with people who:

-Want to play offense, not defense

-Understand credit is a tool for growth

-Refuse to stay average with low scores and limited options

If you’re just “curious,” this isn’t the right fit.

If you’re serious about changing outcomes, you’re in the right place.

How much does the service cost?

Our credit services range from $1,500 to $3,500, depending on the complexity of your file and goals.

Here’s what’s included:

-Monthly 1-on-1 strategy calls with Santiago focused on credit building and approvals

-Access to systems and coaching normally priced at $5,000–$10,000

-Education on new credit rules, lender behavior, and scoring updates while you’re in the program

-Proven tools and strategies designed to accelerate score growth—not just dispute items

We also offer a 120-day money-back guarantee.

If we don’t do what we say, you don’t keep paying for it.

Simple.

Final Truth

Credit repair isn’t about removing items.

It’s about building trust at scale.

If you want someone to send letters, this isn’t for you.

If you want a strategy, education, and long-term leverage, book the call.

We’ll tell you if you’re a fit—either way.

Let's Improve Your Credit Score!

When You Qualify, You'll Get:

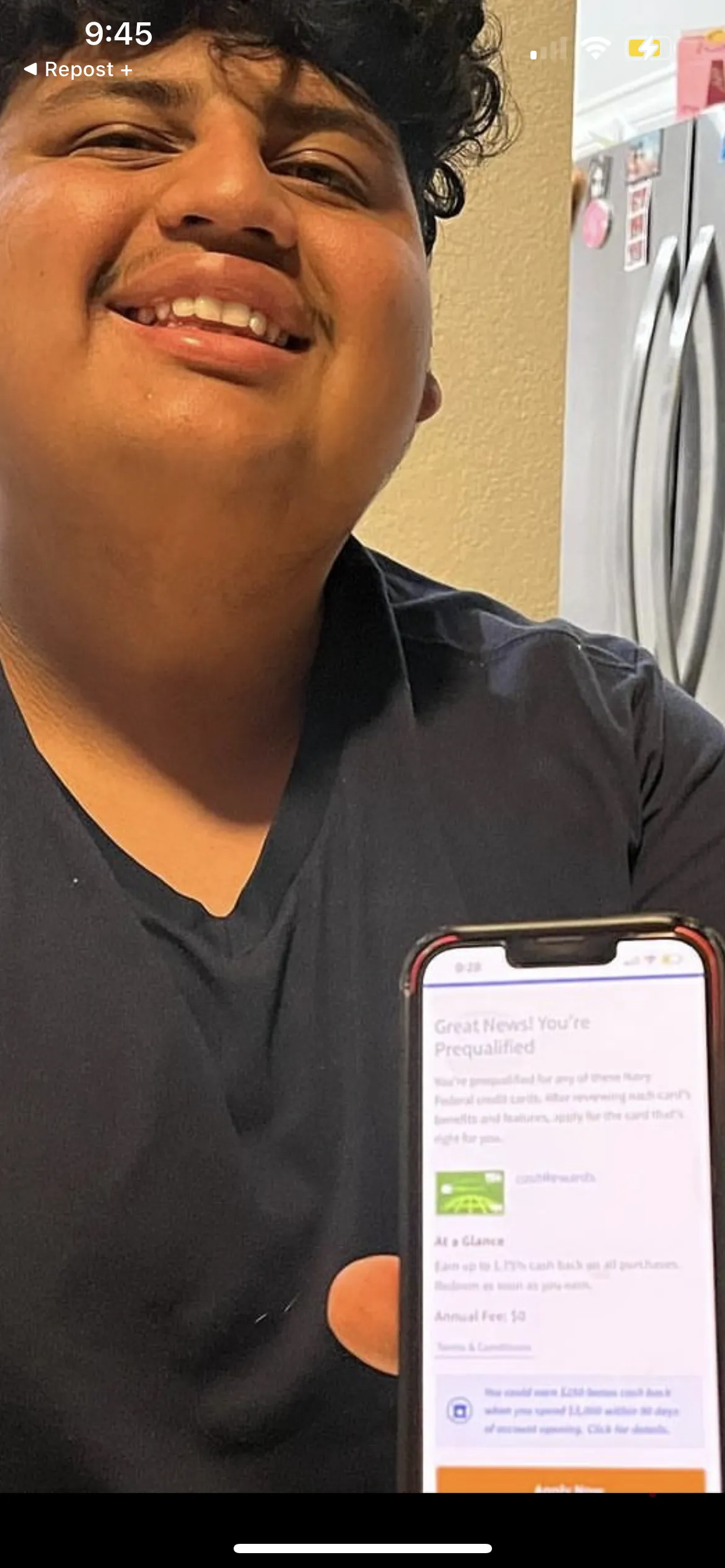

ACCESS TO HIGH LIMIT CREDIT CARDS

PRIVATE SKOOL COMMUNITY

1 Credit Class a Month w/ Founder

Zoom Credit Strategy Call

All rights reserved